- Accident & Injury Protection

- Broken Bones Cover

- Hospitalisation Benefit due to Accident or Sickness¹

- Accidental Death benefit

- Funeral Cover Benefit

- Up to £250,000 Coverage²

- No Medical Questions

- Accident & Injury Protection

- Broken Bones Cover

- Hospitalisation Benefit due to Accident or Sickness¹

- Accidental Death benefit

- Funeral Cover Benefit

- Up to £250,000 Coverage²

- No Medical Questions

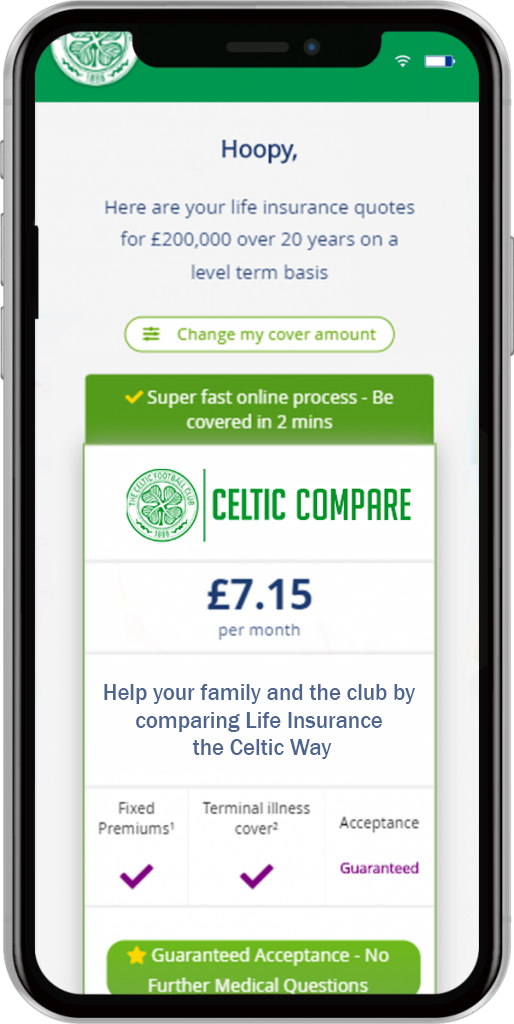

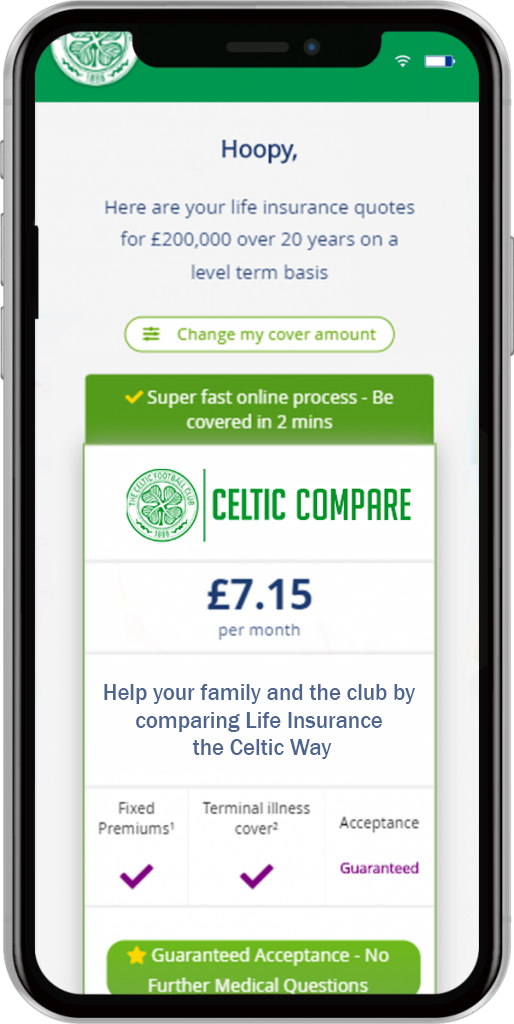

A QUICKER AND SMARTER WAY TO CHOOSE YOUR ACCIDENT PROTECTION INSURANCE

Guidance when you need it

Quick online quotes and telephone help and live chat functions when you need them

Smart technology

Quickly compare the right level of cover for you

Straightforward and hassle free

Superfast online process

Celtic Rewards

Any Celtic fans submitting a free, no obligation enquiry for a quote will gain free access to our exclusive Celtic Rewards Club where you can win prizes such as:

*Please note that due to Covid-19 restrictions match day experiences, hospitality and mascot prizes will only be available when restrictions have eased. Alternatives will be offered, please contact us for more details.

Get the freedom to enjoy life without the worry of what might happen if you’re ill, injured or need to spend time in hospital.

EverydayProtect provides financial support for you 24/7 worldwide by covering a range of injuries from broken bones to those that could have a significant impact on your life. You will also be covered if you have to spend time in a UK hospital and, with our extended cover options, you can protect your children as well.

EverydayProtect pays a lump sum for:

- Broken Bones – caused by an accident

- Accidental permanent injuries – including paralysis, loss of a hand or foot or loss of a major organ

- Accidental total permanent disablement

- Accidental death

- UK hospital stays as a result of an accident – from 12 months you are also covered for hospital stays from sickness

- Up to £10,000 Funeral benefit (subject to deferred period)

- Optional Child Benefit (Cover all of your dependent children from as little as £2 per month)

- Optional Active Lifestyle benefit to cover one dislocation and one complete tendon rupture or complete ligament tear in each policy year

To find out more and for full details of all benefits and exclusions, please refer to your:

¹Hospitilisation benefit for sickness available once you have had the cover in place for 12 months.

²£250,000 is the maximum payout on the 5 unit plan from £50 per month. Policy subject to acceptance. Available to UK residents aged 18-64.